Post Covid-19: An outlook on Infrastructure Spending

The Coronavirus pandemic is a watershed moment for the global infrastructure sector. At one point we thought the situation was easing, however over the past few weeks it has become evident that the pandemic tension is gradually returning; the aftermath of government regulations to curb the spread of the virus will live with us for a long time. Austere measures such as total lockdowns have disrupted supply chain and logistics in no small way. This has led to a standstill in major programmes and infrastructure projects, delayed project timelines and out-of-work period for day workers. Put these factors together, and we get one dominant storyline; infrastructure investment will never be the same.

In economies such as the UK and Ireland, we are seeing a race to ramp up infrastructure projects that will probably run for the next five years. HS2 and the recent approval of the North-South electricity interconnector project by the Irish Ministry of Infrastructure are among many examples of various governments rushing to get more infrastructure in place.

In this article, I explore the impacts of Covid-19 on key infrastructure trends, especially government spending. These trends will have a more lasting impact on infrastructure in the coming years.

Why Spend on Infrastructure?

Before Covid-19, most economies, especially developing economies, were already grappling with huge infrastructure gaps. According to the Global Infrastructure Hub, frontier economies mostly in Africa require $15 trillion to foot their infrastructural needs from 2016 to 2040. In the UK, about £500 billion is required to bridge the infrastructure gap.

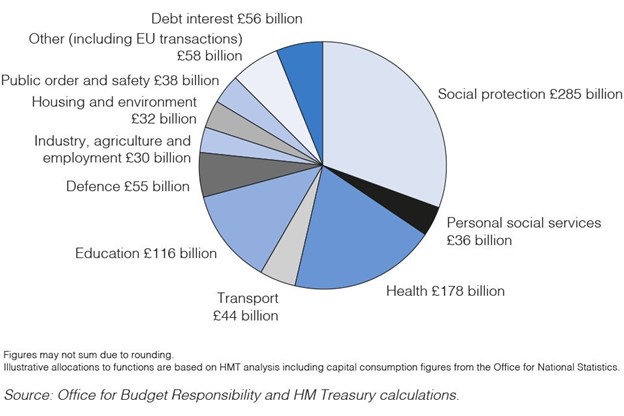

With the pandemic, many governments now find themselves at crossroads between increasing infrastructure spending to stimulate economic recovery and growth or to slash infrastructure spending altogether. The latter, will be suicidal to their recovery from the impact of Covid-19, more than ever, governments will be under pressure to spend more on core infrastructure such as transport, electricity, digital connectivity, healthcare and a host of others.

The reasons are not far-fetched. Spending on infrastructure has tons of benefits.

1. For one, more road networks will increase the mobility of workers and power the logistics needed for businesses to deliver products and services to consumers. This means faster delivery, lower shipping and inventory costs, increased efficiency and of course, more profits for businesses.

When workers can find jobs a stone throw away from their home city and jobs that sync with their skills, it leads to high labour productivity, wages and ultimately, an increase in their standard of living.

2. Job creation. In the 1930s, the major link between infrastructure and job creation was often the jobs associated with the hands-on construction of an infrastructure project. Today, major infrastructure projects such as roads and railroads use advanced machinery and skilled labour. Jobs will be created from the impact on mobility and rising labour productivity than from jobs associated with the hands-on construction of a railroad.

3. Also, the expansion of airports and subway stations will promote long-distance mobility and of course, international trade. This will improve the poor standard of living from what we have currently have as of today.

4. Last but not the least, is potable water. Potable water and functional sewage systems will improve population health, reduce infant mortality, curb the spread of diseases and ultimately increase life expectancy. Higher life expectancy means more people in the workforce for longer periods. Healthier infants and adults mean better learning potential and high human capital. Put together, these factors will impact national productivity, human capital and increase economic growth.

What Countries Are Doing to Invest in Core Infrastructure

1. The United Kingdom

In July 2020, the London Recovery Board announced a £1.5 billion Infrastructure Investment Package. The goal is to help chart a recovery plan that will create jobs and regulate the city’s carbon footprints. Although the specific infrastructure projects and their allotted budgets are yet to be released, the focus will be to refurbish the city’s water infrastructure; reduce water pollution incidents by 30%, decrease leakage by 20% and expand London’s electric vehicle charging infrastructure.

2. China

Post COVID-19, China’s new infrastructure plan will focus on stimulating job creation and preparing for new realities of the global economy. Especially as in technology and sustainable development.

The Chinese government announced that it will pipe low on its Made-in-China campaign by 2025. The focus will now be to spend at least $1.4 trillion on its new digital infrastructure public program. The programme captures 7 key areas:

· Industrial internet

· Artificial Intelligence

· 5G networks

· Inter-city transportation and rail system

· Data centres

· New-energy vehicle charging stations and

· Ultra-high voltage power transmission.

3. The United States Of America

As part of its overall recovery plan, the US government will make what it calls Targeted Discretionary Investments to address core infrastructure needs.

$2 billion will be spent on Infrastructure for Rebuilding America (INFRA) grant program. In the past, INFRA focused on large projects that relieve congestion and lessen bottlenecks on the US’s strategic freight networks such as interstate roads, railroads and seaports. Post Covid-19, the programme will receive an additional $1 billion to continue its efforts to bridge the US’ infrastructure gap (The White House, 2020)

$1 billion will be spent on Better Utilizing Investment to Leverage Development (BUILD) grant program. BUILD focuses on vital surface transportation projects in urban and rural communities across the US. $300 million will go into state highway and bridge projects, while another $300 million will go into water infrastructure investments.

Conclusion

Going forward, more policymakers will maintain support for investment in infrastructure. However, funding will not be the sole responsibility of the governments. As always, the private sector will be instrumental in funding infrastructure to achieve sustainable economic recovery and growth.